Whatever you enjoy now,

keep it going later

Life is more than paying bills and showing up for work - it’s the little things, and sometimes not-so-little things, that make life feel special. Later in life, this is no different. A daily latte, weekends away, your gym membership - these might be part of your normal everyday routine and easily affordable while you’re working, but once you stop, you’ll still want to enjoy these moments. That’s where retirement planning becomes essential.

Be smart, be secure – be future ready

Recent insights from an Insurance Europe Pan-European Pension Survey show just how important this planning is for people in Ireland. Around 35–40% of Irish respondents say they are not familiar with how the Irish pension system works, and more than 70% believe they’ll need additional private savings to maintain their standard of living after retirement. Many expect that the State and workplace pensions together will only provide around 45–50% of their final salary, which could leave a significant gap between what people hope for in retirement and what their income will actually be.

For the average worker, it’s estimated you could need around 80% of your current income to maintain the same standard of living in retirement as you have while working. When you compare this to what most people expect to receive, it’s clear that a gap can emerge quickly.

35–40%

of Irish respondents say they are not familiar with how the Irish pension system works

45–50%

Many expect that the State and workplace pensions together will only provide around 45–50% of their final salary

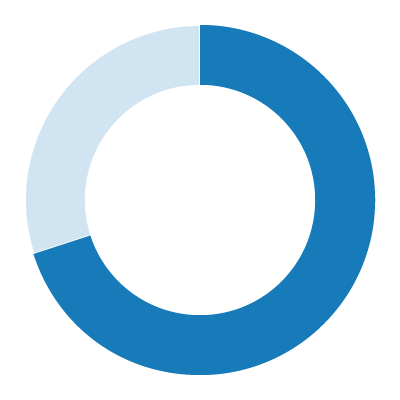

70%

believe they’ll need additional private savings to maintain their standard of living after retirement

80%

around 80% of current income (average worker) needed to maintain same standard of living in retirement

The facts

Shopping aroundNot sure what to say?

Learn more about how to buy motor insurance, life insurance and home insurance.